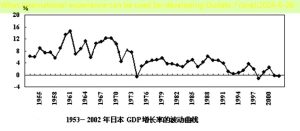

China’s legal deposit reserve ratio still has a decline in the "reduction" of "reduction" is conducive to stimulating economic growth

3 min read

CCTV News: A few days ago, the relevant person in charge of the People’s Bank of China stated at the press conference of the National New Office that “there is still room for decline in the legal deposit reserve rate in my country.” EssenceSo, what is a legal deposit reserve ratio?What is the relationship between it and the economic operation?Look at the reporter’s interview with industry insiders.

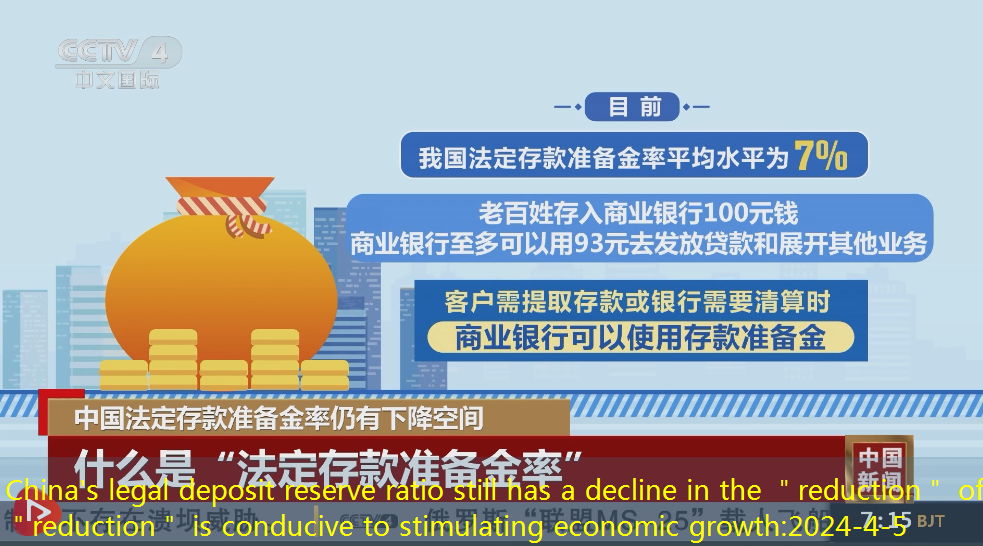

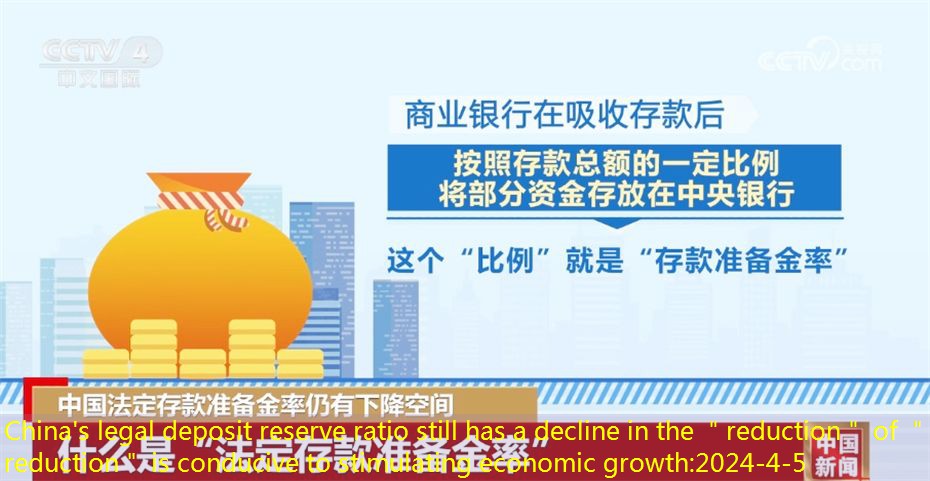

After absorbing deposits, commercial banks must deposit some funds in the central bank according to a certain percentage of the total amount of deposits. This ratio is the deposit reserve ratio.At present, the average level of legal deposit reserve rate in my country is 7%. That is to say, ordinary people deposit 100 yuan in commercial banks, and commercial banks can use up to 93 yuan to issue loans and start other businesses.When a customer needs to extract deposits or banks need to liquidate, commercial banks can use deposit reserve.

Adjusting the deposit reserve ratio is a type of monetary policy of the central bank. The central bank will comprehensively judge the current economic operation and choose the monetary policy tools.

The central bank’s adjustment of the deposit reserve rate will bring changes in currency supply.The deposit reserve ratio is reduced, bringing increase in currency supply; the statutory deposit reserve rate increases, and the currency supply is reduced.

Wang Qing, chief macro analyst at Dongfang Jincheng, said: “Combining the current inflation level of our country, it currently provides space for the central bank’s implementation of the reduction.”

The decrease in the deposit reserve rate means that the available funds of commercial banks have increased, and the credit release capacity of commercial banks will increase.

Tian Lihui, dean of the Institute of Financial Development of Nankai University, analyzed: “The reduction will reduce the amount of reserve deposits stored in central banks in the central bank, which increases the amount of loan funds for commercial banks.More loan -available funds are invested in support for the real economy. This is positive for economic development, and banks can also get more interest income. “

Experts said that as a type of monetary policy of the Central Bank, the change in the deposit reserve ratio will be transmitted to economic operation to a certain extent through commercial banks.

Tian Lihui, the dean of the Institute of Finance Development of Nankai University, said: “The deposit reserve ratio is mainly to control the scale of commercial bank loan funds. If you need to stimulate economic growth and drive employment, you can reduce the deposit reserve rate and increase the loan through commercial banks to loans.The funds that are exported will increase the funds and capital of the society. For enterprises and other lenders, loans will be relatively easier. “

At the same time, experts said that the impact of adjusting the deposit reserve ratio on the real economy is sometimes not immediate, and the effect takes time to be transmitted to the economic operation, and the sensitivity and response of monetary policy in different industries and regions may also be different.