625 stocks were investigated by public offering!Which is the most optimistic?

5 min read

In the past month, the fund manager is busy investigating and trying to tap subsequent investment opportunities.So, which track are they optimistic?

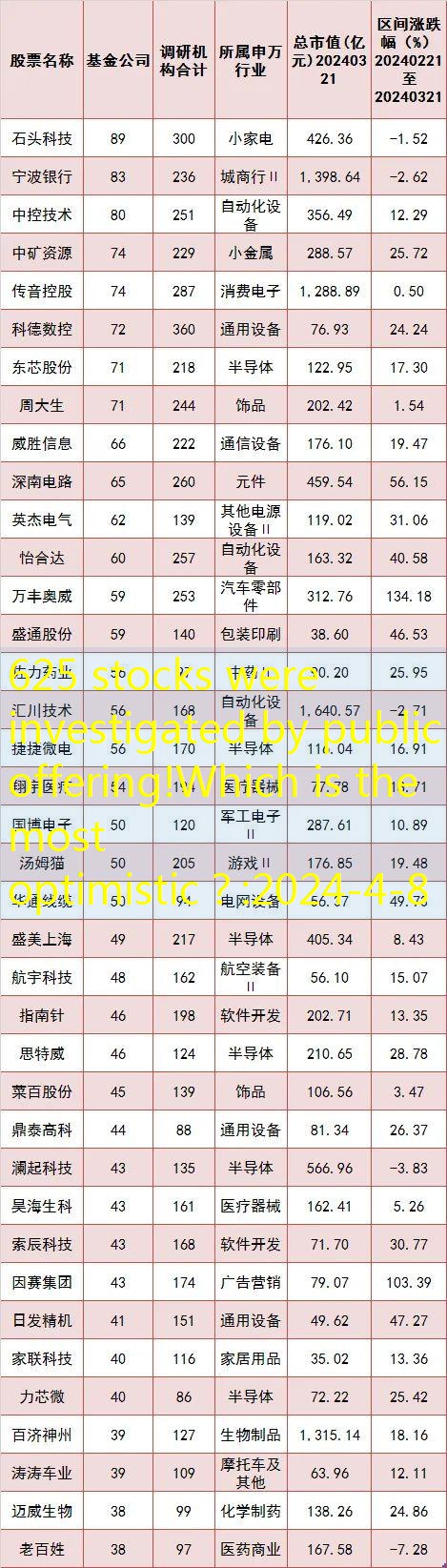

On March 21, a reporter from the International Financial News sorted out and found that in the past month, the institution has investigated a total of 795 A -share listed companies.Among them, the fund company investigated 625 A -share listed companies, covering multiple fields such as mechanical equipment, electronics, and power equipment.

Data source: iFind watch: Wei Lai

Home appliances, banks are followed

In the past month, the fund company’s attention to Stone Technology is the forefront.According to Flush iFind data, as of March 21, a total of 300 institutions including 89 funds including 89 funds in the past month have investigated it.

Shito Technology’s 2023 performance report shows that the company achieved operating income of 8.654 billion yuan in 2023, an increase of 30.55%year -on -year; the total profit was 2.326 billion yuan, an increase of 72.38%year -on -year;Increased by 73.57%.

In the survey, Stone Technology stated that in the global market, the company actively practiced the strategy of walking out in 2023, continued to enhance product competitiveness, and created a mid -to -high -end image.Overseas income has achieved rapid growth, and market share has continued to rise.In 2023, the company was listed on a number of new products, and the price section of the sweeper was further improved, which promoted the continuous improvement of the company’s operating performance and profitability.The performance of the ground washing machine and the new category washing and drying machines can be remarkable, and the effective expansion of the product line is realized, which mainly reflects the company’s strength in scientific and technological innovation and market development.

On March 21, Stone Technology closed at 324.28 yuan/share, and the stock price fell 2.33%on the day, with a total market value of 42.6 billion yuan.In the past month, Stone Technology’s stock price has fallen by 1.52%.As of the end of 2023, Stone Technology was held by 136 funds, accounting for 9.98%of circulating shares.

Bank of Ningbo was targeted by 83 fund companies in the past month, and the fund company’s attention was second only to Stone Technology.

Bank of Ningbo’s 2023 performance report shows that the company achieved operating income of 61.584 billion yuan throughout the year, an increase of 6.40%over the same period last year; net profit attributable to shareholders of the parent company was 25.535 billion yuan, an increase of 10.66%over the same period last year.

Talking about how to gain advantages in industry competition, Bank of Ningbo said in the investigation that the company adheres to differentiated business strategies, actively adapts to changes in the operating environment, continuously accumulates differentiated comparative advantages, and promotes the high -quality development of banks.Promote sustainable development; the second is to strengthen professional operations and consolidate the core advantages; third, to accelerate the transformation of science and technology and empower business management; the fourth is to keep the risk bottom line and ensure smooth operation.

On March 21, Bank of Ningbo closed at 21.18 yuan/share, and the stock price rose 1.1%on the day, with a total market value of 139.9 billion yuan.In the past month, the stock price of Ningbo Bank has fallen by 2.62%.As of the end of 2023, Bank of Ningbo was held by 141 funds, accounting for 4.08%of circulating shares.

In addition, many A -share listed companies such as central control technology, China Mining Resources, Chuanyin Holdings, and Kodak CNC were investigated by more than 70 fund companies in the past month.

A shares may enter the shocking rectification period

In the first quarter, the fund manager is busy looking for investment direction. The next market trend is also a matter of particular concern to investors.

Minsheng and Silver Fund pointed out that in the country, the market fluctuations caused by liquidity impact and liquidity replenishment in the early stage basically came to an end, and the market gradually returned to a relatively calm state.Market attention will return to key factors such as economic fundamentals, corporate profitability, and border supply and demand for capital.From the perspective of economic fundamentals, the real estate in the past two months is still relatively tired, the production of weak production, and consumption, especially the travel consumption, is still relatively strong, and it is expected that exports are expected to improve margins.From the perspective of the supply side, the demand for new production capacity in manufacturing has fallen significantly. In the future, the supply and demand relationship is expected to improve margin, and the proportion of free cash flow is expected to gradually rise.In this environment, it is conducive to the improvement of the leading share of the industry in the fields of consumption, medicine, manufacturing and technology.On the whole, the profitability of enterprises in the first quarter may show a weak improvement.

In terms of industry, Minsheng and Silver Fund pays attention to precious metals, technology, medicine, electricity, etc.In 2024, the US Federal Reserve entered the interest rate cut cycle may be only a matter of time.Global central banks purchase funds, and the trend of de -to -US dollar continues, which is relatively concerned about precious metals; policies emphasize that scientific and technological innovation is the core element of new productivity, and emerging industry trends such as artificial intelligence are in the ascendant. Consumer electronics innovation such as MR (hybrid reality) has continued.After early adjustment, the valuation of the science and technology sector is prominent; under the interference of geopolitical events, the early CXO (pharmaceutical outsourcing) plunge has driven the pharmaceutical sector to overlook the oversold, and the current valuation is relatively high.In addition, the policy encourages the true innovation of medicine, releases positive signals, and clear the negative impact of anti -corruption in the early stage.

“The market rebound since the beginning of February is the first to repair the negative feedback of liquidity.To go up, you need to see more directional changes in policies or economy. With the approaching period of the first quarter report performance disclosure (April) of listed companies, it is recommended to gradually switch from ‘theme’ to performance.Focus on growth tracks such as semiconductors, communication, medicine and other sectors; this year, it is expected to bottom out power equipment and new energy; high dividends, state -owned assets reorganization, such as coal, electricity, telecommunications, etc. “Furong Fund said.